Schedule an Appointment with Our team and funding experts.

Ready to take control of your finances with a business loan? Schedule an appointment with our experienced loan specialists to explore your options and find the solution that best fits your needs. Whether you're looking to apply for a new loan, discuss repayment plans, or seek financial advice, our team is here to help. Booking an appointment ensures personalized attention and allows us to address your concerns efficiently. Take the first step towards financial stability by scheduling your appointment today.

Testimonials

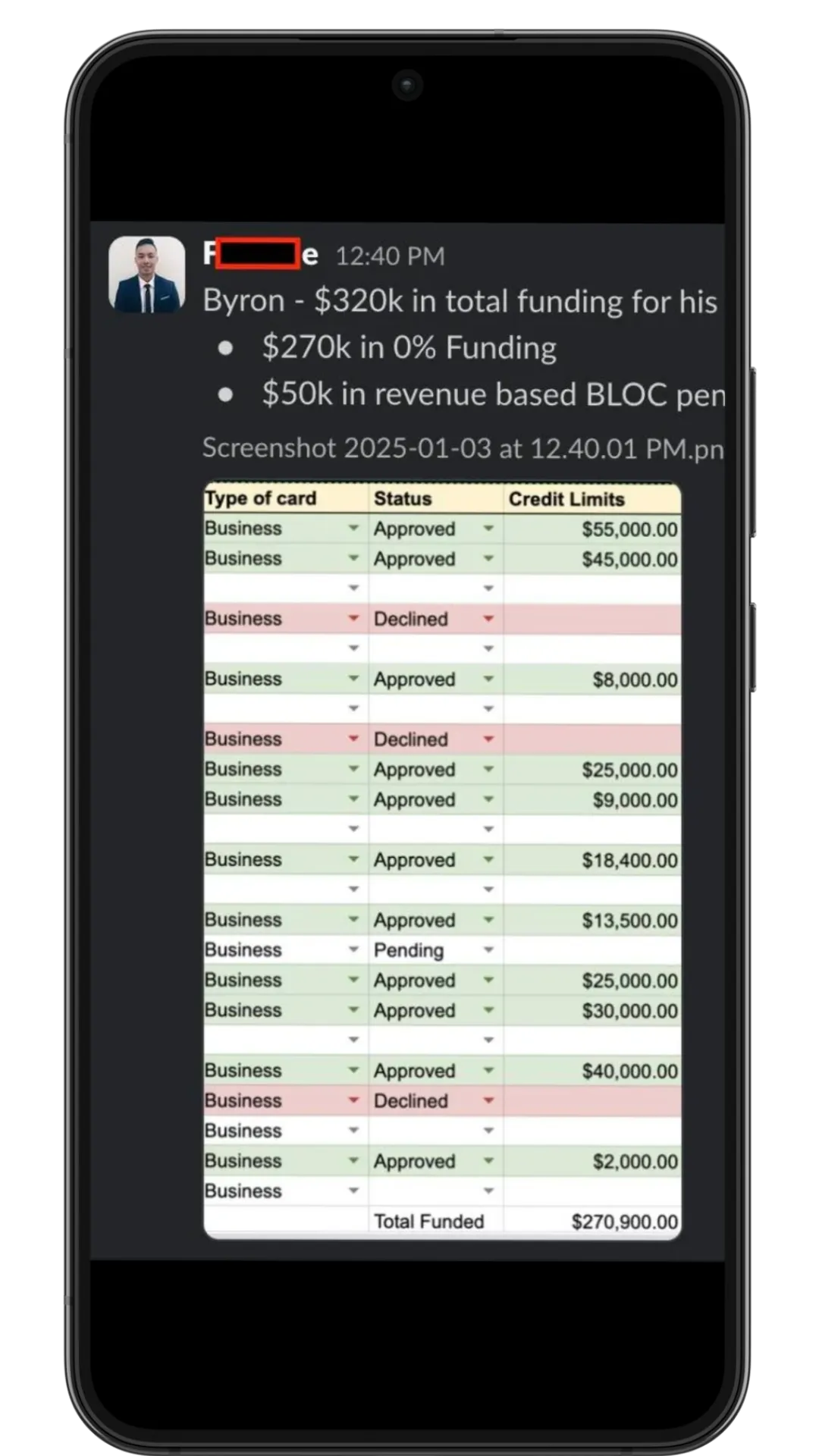

Byron D.

Restaurant - Texas

Secured $270,000 at 0% in 45 days

Deminfer M.

Automotive Services - Indiana Secured $50,000 at 0% in 7 days

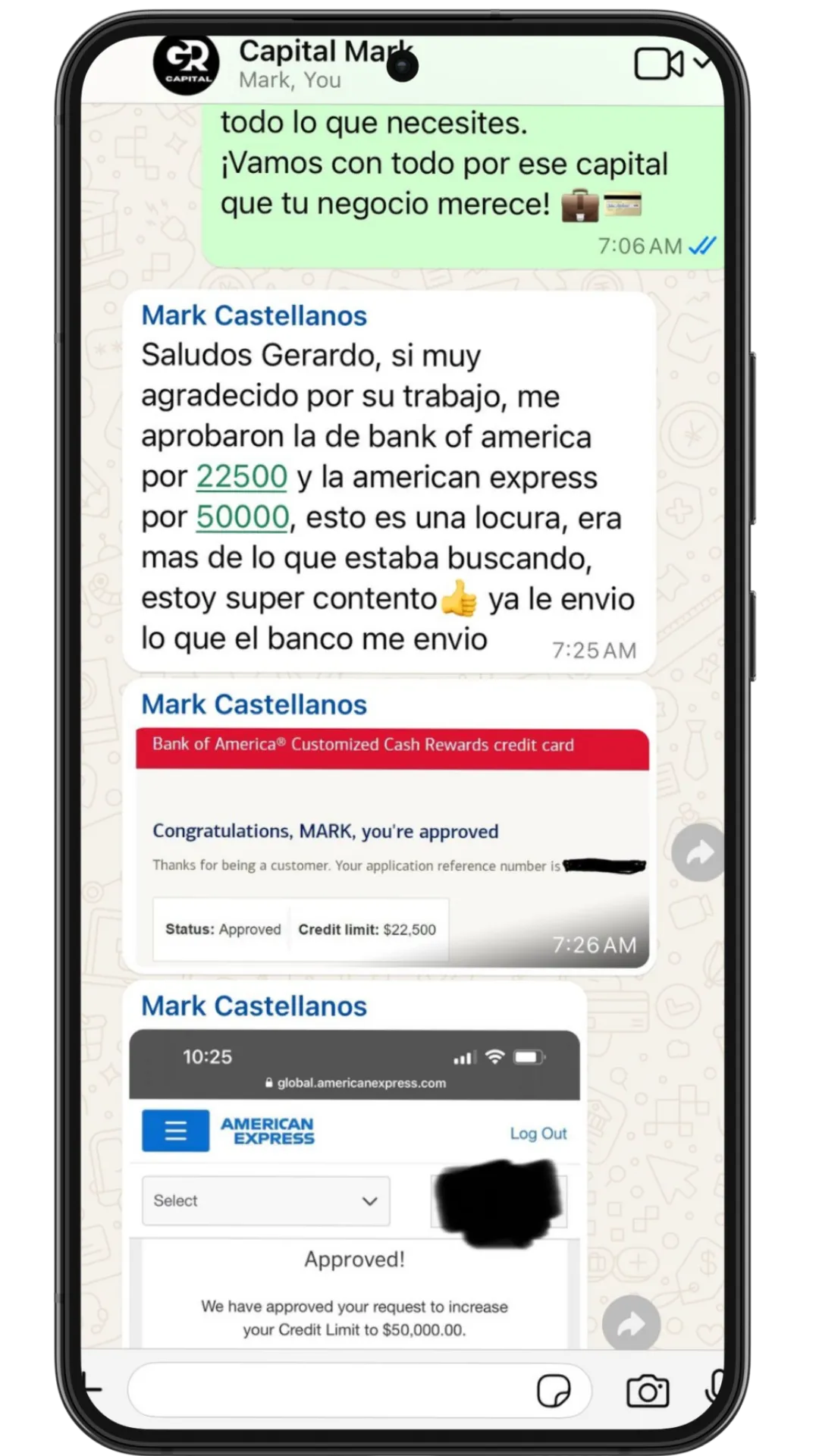

Mark C.

Food Truck - Florida

Secured $72,500 at 0% in 30 days

FAQS

What is 0% Business Capital?

It’s a funding strategy based on business credit cards that allows you to access $50K–$150K at 0% interest for an initial period, using a model known as Credit Stacking. Ideal for startups and growing businesses.

How does the application process work?

It only takes 2 minutes to complete the initial application. Then, our team analyzes your profile and guides you step-by-step to maximize your approval and funding amount.

What kind of credit do I need to qualify?

Ideally, you should have a FICO credit score of 700+, an average credit history of at least 2 years, 3 to 5 open primary accounts, and a personal credit card with a $5,000+ limit for comparable credit. Overall utilization should be below 30%. Your business should be at least 3 months old, with fewer than 3 inquiries per credit bureau. However, we evaluate each case individually and can offer tailored recommendations to strengthen your profile.

What if I have poor credit?

We can help you create a plan to improve your profile, add strategic accounts, or even use guarantors or co-applicants if necessary. We also offer free initial consultations.

How Much In Funding Am I Expected To Get?

It can vary based on personal and business credit history, your personal and business income (if any) the industry, length of time in business and a few other factors. The typical range we see for qualified businesses are $50k - $150k. If you have a business with qualifying documents that can help with contributing to a higher funded amount.

Does this type of funding affect my personal credit?

Not directly. We use business credit cards that typically do not report to personal credit. Additionally, we guide you to avoid impacting your score and help you maintain optimized credit profiles.

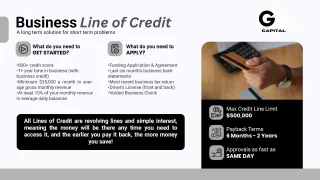

What is a Business Line of Credit (BLOC)?

It’s a type of financing that allows you to access funds as needed, up to a predetermined limit. You only pay interest on the amount you use.

What is a Syndicated Loan Term?

A Syndicated Term Loan is an unsecured personal loan of up to $500,000, ideal for investments, high-ticket services, debt consolidation, or starting a business. No registered business entity is required, and there are no hard credit checks.

How long does it take to receive funding?

Our clients typically receive approvals within 7 to 14 days, and full access to capital within up to 45 days, depending on the type of funding.

Are there any upfront costs?

We don’t charge upfront fees. Our model is transparent, and performance based.

Facebook

Instagram

TikTok